faqs

Frequently asked question

Point-of-Sale add-on allows the trader to use double the leverage (i.e., 1:20). Point-of-Sale add-on that disables “Stoploss Required”; effectively traders can trade without having trades automatically close without a stoploss Point-of-Sale add-on that disables “Flat for Weekend” requirement; this allows traders to keep positions open over the weekend. Point-of-Sale add-on that increases a trader’s potential profit share The Daily Loss Limit is the maximum your account can lose in any given day. Daily Loss Limit is calculated using the previous day balance which resets at 5 PM EST. Unlike other firms, we do NOT base our calculations on previous day equity since the balance only model allows you to scale profits without fear of losing your account. The Daily Stop compounds with the increase in your account. Example: if your prior day's end of day balance (5pm EST) was $100,000, your account would violate the daily stop loss limit if your equity reached $95,000 during the day. If your floating equity is +$5,000 on a $100,000 account, your new- day (5pm EST) max loss is based on your balance from the previous day ($100,000). So, your daily loss limit would still be $95,000. The Maximum Trailing Drawdown is initially set at 6% and trails (using CLOSED BALANCE - NOT equity) your account until you have achieved a 6% return in your account. Once you have achieved a 6% return the Maximum Trailing Drawdown no longer trails and is permanently locked in at your starting balance. This allows for more trading flexibility. Example: If your starting balance is $100,000, you can drawdown to $94,000 before you would violate the Maximum Trailing Drawdown rule. Then for example let's say you take your account to $102,000 in CLOSED BALANCE. This is your new high-water mark, which would mean your new Maximum Trailing Drawdown would be $96,000. Next, let's say you take your account to $106,000 in CLOSED BALANCE, which would be your new high-water mark. At this point your Maximum Trailing Drawdown would be locked in at your starting balance of $100,000. So, regardless of how high your account goes, you would only breach this rule if your account drew back down to $100,000 (note, you can still violate the daily drawdown). For example, if you take your account to $170,000, as long as you do not drawdown more than 5% in any given day, you would only breach if your account equity reaches $100,000. There is currently no max lots limit Yes. If you do not place a trade at least once every 30 days on your account, we will consider you inactive and your account will be breached. We work with a company called Deel to issue trader agreements and process withdrawals of gains in your Funded Account. Upon passing your Assessment, you will receive an email from Deel with instructions on how to access and complete your Trader Agreement. Once the agreement is completed and supporting documentation is provided, your Funded Account will be created, funded and issued to you typically within 24-48 business hours. Once you pass the Assessment, we provide you with a live account, backed by our capital. The capital in your Funded Account is notional and may not match the amount of capital on deposit with the Broker. A Funded Account is notionally funded when actual funds in the account (i.e., the equity in a Funded Account represented by the amount of capital) differs from the nominal account size (i.e., the size of the Funded Account that establishes the initial account value and level of trading). Notional funds are the difference between nominal account size and actual capital in a Funded Account. Use of notional funding does not change the trading level or that the account may trade in any manner differently than if notional funds were not used. In particular, the same conditions and rules applicable to a soft breach, hard breach, Daily Loss Limit, Max Trailing Drawdown, stop loss and position limits apply. For example, if you have a $100,000 account and you grow that account to $110,000. Should you then have a hard breach we would close the account. Of the $10,000 in gains in your Funded Account, you would be paid your portion thereof. If the Double Leverage Add-on is purchased, Forex and Metals will be 20:1. Please note that holidays can have an impact on available trading hours. We use the RAW accounts from the Broker. These accounts have commission charges for Forex and Equity Share CFDs. The other products do not carry a commission. Subject to our policy on Prohibited Trading as described below, you can trade using an Expert Advisor. You are also prohibited from using any trading strategy that is expressly prohibited by the Company or the Brokers it uses. Such prohibited trading (“Prohibited Trading”) shall include, but not be limited to: To view all Prohibited Uses, please review our Terms and Conditions here, https://dashboardanalytix.com/client-terms-and-policies/?v=7516fd43adaa. Yes, you can trade during the news provided that pricing data from the Broker continue to be provided. Charges come across in the name of Dashboardanalytix.com. When trading a Funded Account for our firm, you are treated as an independent contractor. As a result, you are responsible for any and all taxes on your gains. Affiliates are credited for referrals when a new user to the prop firm creates an account using a link or discount code provided by the Affiliate. Affiliates are not credited for subsequent purchases made by the referred customer and customers cannot be attached to an affiliate after they’ve created an account. Start investing with purpose, and together, we can drive positive change. Sign up now to empower your portfolio and make a meaningful impact. Impact Trader is an affiliate of Prop Account, LLC. All content published and distributed by Prop Account, LLC and its affiliates (collectively, the Company) is to be treated as general information only. None of the information provided by the Company or contained herein is intended as investment advice, an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any security, company, or fund. Use of the information contained on the Company’s websites is at your own risk and the Company and assumes no responsibility or liability for any use or misuse of such information. Nothing contained herein is a solicitation or an offer to buy or sell futures, options, or forex. Past performance is not necessarily indicative of future results. Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, because the trades have not actually been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.ADD-ons

Add-ons (available at purchase)

Double Leverage (25% Cost)

No Stop Loss (10% Cost)

Hold Over Weekend (10% Cost)

Profit Share Increased to 90% (20% Cost)

for funded accounts to 90% (up from the standard 75%) of the profit.Trading

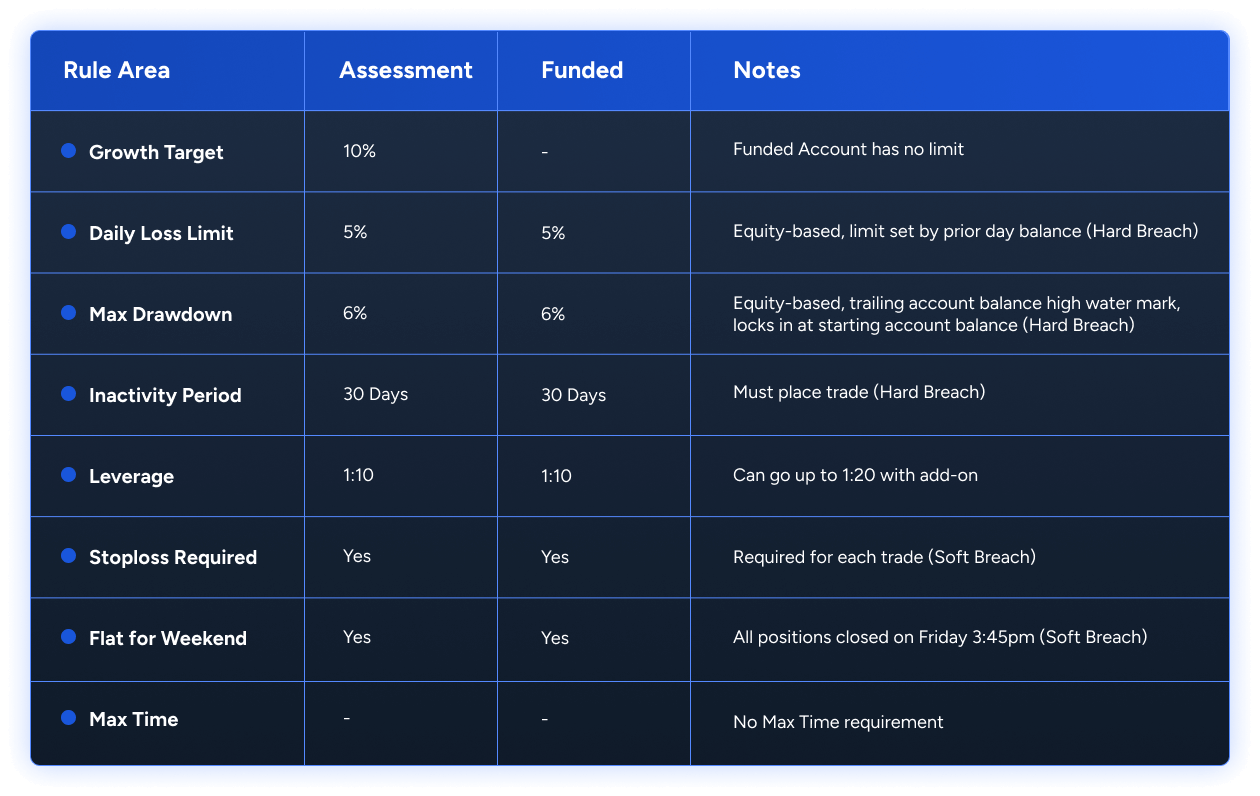

Trading Rules

What is the difference between a Hard Breach and Soft Breach rule?

How do you calculate the 5% Daily Loss Limit?

How do you calculate the Maximum Trailing Drawdown?

Why do I have to place a stop loss on trades?

Can I hold positions over the weekend?

What is 1 lot equal to on the Trading Platform?

How many lots can I trade? (Max Lots with Risk)

Is there a breach for inactivity?

FUNDED

FUNDED ACCOUNTS

How Long does it take to receive my Funded Account?

Once I pass the Assessment am I provided with a demo or live account for my Funded Account?

Do we manipulate the pricing or executions you receive in your Funded Account?

Who is the counterparty to my trades?

Am I subject to any position limits?

What are the rules for the Funded Account?

If I have a hard breach in my Funded Account and there are gains in the account, do I forfeit those gains?

How do I withdraw the gains in my Funded Account?

When can I withdraw the gains in my Funded Account and how does that affect my Maximum Trailing Drawdown?

OTHER

OTHER GENERAL QUESTIONS

Do I have to use one of your accounts for the Assessment or can I use my own?

What Countries are accepted?

What is the minimum age I must be to be part of your program?

Where do I track the progress of my account?

What Platform can I trade on?

What products can I trade?

What is the leverage?

What are the trading hours?

Additionally, pursuant to the no holding trades over the weekend rule, we close all open trades at 3:45pm EST on Fridays.Do your accounts charge commissions?

Can I use an Expert Advisor?

What is the policy on Prohibited Trading Activity?

Can I trade during News Events?

How will I see the charge on my Statement?

How are taxes handled?

How are affiliates credited?

Join Impact trader today

ADD-ons

Add-ons(available at purchase)

No Stop Loss (10% Cost)

Hold Over Weekend (10% Cost)

Profit Share Increased to 90% (20% Cost)

Trading

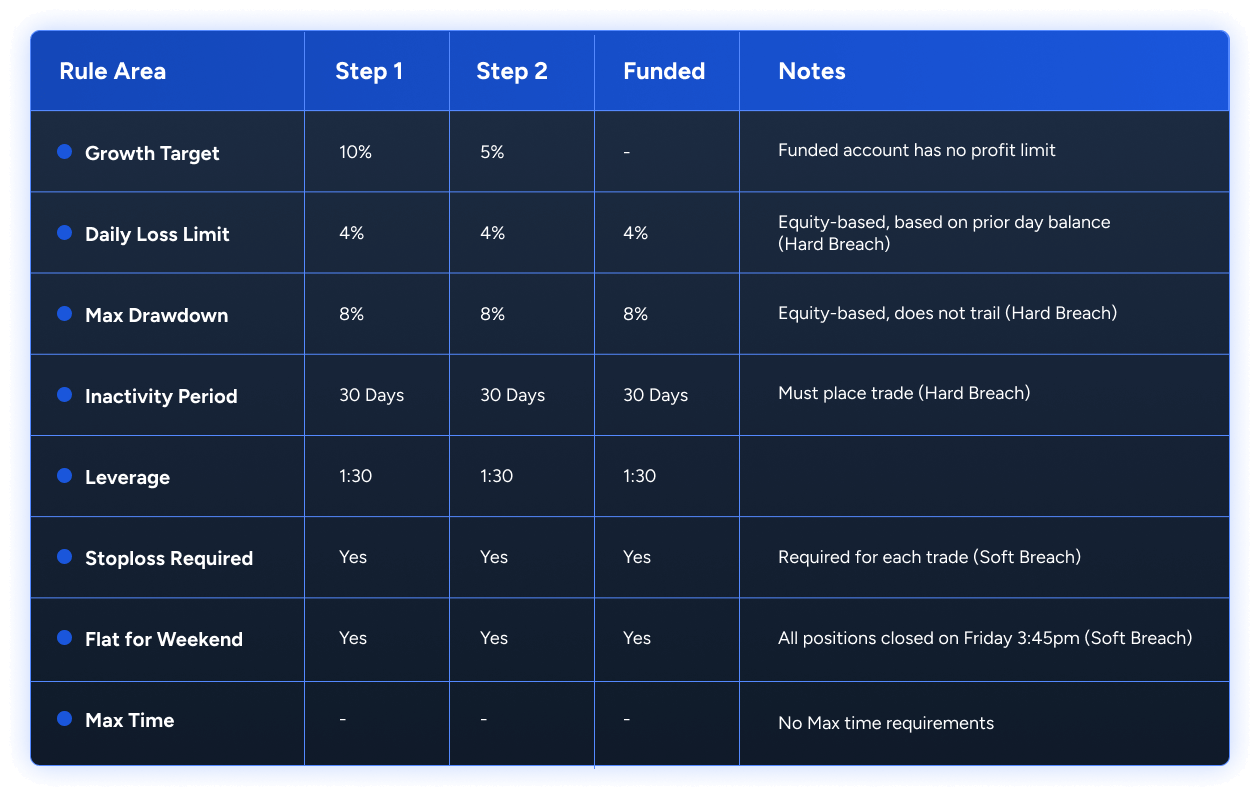

Trading Rules

What is the difference between a Hard Breach and Soft Breach rule?

- Soft breach means that we will close all trades that have violated the rule. However, you can continue trading in your Assessment or Funded Account.

- Hard breach means that you violated either the Daily Loss Limit or Max Trailing Drawdown rule. Both rules constitute a hard breach. In the event you have a hard breach, you will fail the Assessment or have your Funded Account taken away.

How do you calculate the 4% Daily Loss Limit?

Example: if your prior day's end of day balance (5pm EST) was $100,000, your account would violate the daily stop loss limit if your equity reached $96,000 during the day. If your floating equity is +$6,000 on a $100,000 account, your new- day (5pm EST) max loss is based on your balance from the previous day ($100,000). So, your daily loss limit would still be

$96,000.

How do you calculate the 8% Max Drawdown?

Why do I have to place a stop loss on trades?

Can I hold positions over the weekend?

What is 1 lot equal to on the Trading Platform?

- Forex - 1 lot = $100k notional

- Index - 1 lot = 10 Contracts

- Cryptos - 1 lot = 1 coin

- Stocks - 1 lot = 100 shares

- Silver - 1 lot = 5000 ounces

- Gold - 1 lot = 100 ounces

- Oil - 1 lot = 1000 barrels

How many lots can I trade? (Max Lots with Risk)

There is currently no max lots limit

Is there a breach for inactivity?

Yes. If you do not place a trade at least once every 30 days on your account, we will consider you inactive and your account will be breached.

FUNDED

FUNDED ACCOUNTS

How Long does it take to receive my Funded Account?

Upon passing your Assessment, you will receive an email with instructions on how to access and complete your Trader Agreement and submit your AML/KYC documents. Once the agreement is completed and supporting documentation is provided, your Funded Account will be created, funded and issued to you typically within 24-48 business hours.

Once I pass the Assessment am I provided with a demo or live account for my Funded Account?

Use of notional funding does not change the trading level or that the account may trade in any manner differently than if notional funds were not used. In particular, the same conditions and rules applicable to a soft breach, hard breach, Daily Loss Limit, Max Trailing Drawdown, stop loss and position limits apply.

Do we manipulate the pricing or executions you receive in your Funded Account?

Who is the counterparty to my trades?

Am I subject to any position limits?

What are the rules for the Funded Account?

If I have a hard breach in my Funded Account and there are gains in the account, do I forfeit those gains?

For example, if you have a $100,000 account and you grow that account to $110,000. Should you then have a hard breach we would close the account. Of the $10,000 in gains in your Funded Account, you would be paid your portion thereof.

How do I withdraw the gains in my Funded Account?

When can I withdraw the gains in my Funded Account and how does that affect my Maximum Trailing Drawdown?

OTHER

OTHER GENERAL QUESTIONS

Do I have to use one of your accounts for the Assessment or can I use my own?

What Countries are accepted?

What is the minimum age I must be to be part of your program?

Where do I track the progress of my account?

What Platform can I trade on?

What products can I trade?

What is the leverage?

What are the trading hours?

Please note that holidays can have an impact on available trading hours.

Additionally, pursuant to the no holding trades over the weekend rule, we close all open trades at 3:45pm EST on Fridays.

Do your accounts charge commissions?

Can I use an Expert Advisor?

Subject to our policy on Prohibited Trading as described below, you can trade using an Expert Advisor.

What is the policy on Prohibited Trading Activity?

You are also prohibited from using any trading strategy that is expressly prohibited by the Company or the Brokers it uses. Such prohibited trading (“Prohibited Trading”) shall include, but not be limited to:

- Exploiting errors or latency in the pricing and/or platform(s) provided by the Broker

- Utilizing non-public and/or insider information

- Front-running of trades placed elsewhere

- Trading in any way that jeopardizes the relationship that the Company has with a Broker or may result in the canceling of trades

- Trading in any way that creates regulatory issues for the Broker

- Utilizing any third-party strategy, off-the-shelf strategy or one marketed to pass challenge accounts

- Utilizing one strategy to pass an assessment and then utilizing a different strategy in a funded account, as determined by the Company in cooperation with Prop Account, LLC at their discretion

- Holding a Single Share Equity CFD position into an earnings release pertaining to that underlying equity. To avoid being in breach of this rule, you must close all such Single Share Equity CFD positions by 3:50 pm Eastern Time on the day of the release, if an aftermarket release, or on the preceding day, if a before market open release. Violation of this rule will constitute an immediate, hard breach of your account and any gain or loss on said position will be removed from any calculations.

- Entering into an Equity CFD at or near the end of the trading day with intent of profiting from the marketing gap between when the market closes and reopens on the subsequent trading day, as determined by the Company in its sole and absolute discretion.

- Attempting to arbitrage an assessment account with another account with the Company or any third-party company, as determined by the Company in its sole and absolute discretion.

If we detect that your trading constitutes Prohibited Trading, your participation in the program will be terminated and may include forfeiture of any fees paid to us. Additionally, and before you shall receive a funded account, the trading activity of the Trader under these Terms and Conditions shall be reviewed by us to determine whether such trading activity constitutes Prohibited Trading. In the case of Prohibited Trading, the Trader shall not receive a Funded Account.

Additionally, we reserve the right to disallow or block You from participating in the program for any reason, in our sole and absolute discretion.

To view all Prohibited Uses, please review our Terms and Conditions here, https://dashboardanalytix.com/client-terms-and-policies/?v=7516fd43adaa.

Can I trade during News Events?

How will I see the charge on my Statement?

How are taxes handled?

How are affiliates credited?

Join Impact trader today

Start investing with purpose, and together, we can drive positive change. Sign up now to empower your portfolio and make a meaningful impact.

Impact Trader is an affiliate of Prop Account, LLC. All content published and distributed by Prop Account, LLC and its affiliates (collectively, the Company) is to be treated as general information only. None of the information provided by the Company or contained herein is intended as investment advice, an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any security, company, or fund. Use of the information contained on the Company’s websites is at your own risk and the Company and assumes no responsibility or liability for any use or misuse of such information. Nothing contained herein is a solicitation or an offer to buy or sell futures, options, or forex. Past performance is not necessarily indicative of future results. Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, because the trades have not actually been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.